As I have written about in the past, the Medicare “Trustees” issue a comprehensive report annually that outlines the financial outlook for the Medicare program in both the short-term and the long-term (for more background information about these reports and how Medicare is financed in general, please refer to my previous blog post). This year’s Trustees report was just released last week.

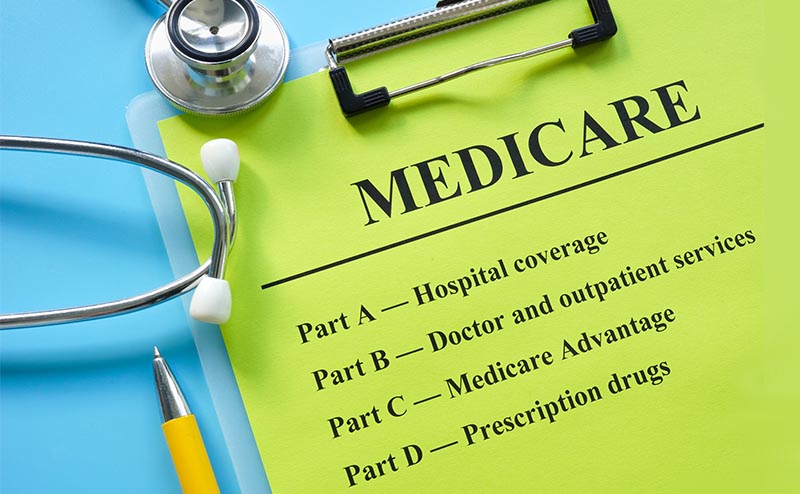

Most people in the health policy world look out for one main thing in the Trustees report: the insolvency date for the Hospital Insurance (HI) Trust Fund. The year's report estimates that the HI Trust Fund, which covers costs under Medicare Part A, will be depleted by 2028, two years later than estimated in last year’s report. This means that Congress and the Centers for Medicare & Medicaid Services (CMS) have a little more time to figure out how either to increase income (i.e., payroll taxes) or decrease spending to avoid the HI Trust Fund going bankrupt. It definitely remains to be seen what actions Congress and/or CMS will actually take—as any attempts to increase payroll taxes or cut Medicare spending for hospitals and other facilities (which are reimbursed under Medicare Part A) will obviously be extremely unpopular.

However, for the last couple years when the Trustees report has been released, I have immediately looked at a section in the report that describes long-term spending for the Supplementary Medical Insurance (SMI) Trust Fund, which covers Medicare Part B (including physician) spending. It is important to remember that the SMI Trust Fund does not face the same fiscal challenges as the HI Trust Fund does. The financing of the SMI Trust Fund is structured in such a way that income from Medicare premiums and general revenue from the Treasury are reset each year to cover expected costs and preserve an adequate contingency margin. In other words, the SMI Trust Fund can’t go bankrupt.

Although the SMI Trust Fund may not have the fiscal challenges that the HI Trust Fund does, there is another significant issue that the Medicare Trustees have pointed out the last few years—the inadequacy of physician payments. Like last year, the Medicare Trustees state in this report that, due to the low reimbursement rates, access to Medicare-participating physicians will become a significant issue in the long term absent a change in law. Further, although Medicare physician payments were unsustainably low under the “sustainable growth rate” (SGR) formula—which was repealed in 2015 by the Medicare Access and CHIP Reauthorization Act (MACRA)— the Trustees re-emphasize the point that physician payments will be lower than they would have been under the SGR formula by 2048. In other words, the current physician payment system will actually be worse for physicians in the long term than it would have been if the SGR formula had remained in place—even though the primary purpose of MACRA was to be a viable solution to the broken SGR formula!

It is truly remarkable that the Medicare Trustees—who include the Secretaries of the Departments of Health and Human Services (HHS), Labor, and Treasury, as well the Commissioner of the Social Security Administration—openly admit this fact year after year. Although the actuaries at CMS actually draft the report, the Trustees must sign off on it and therefore take ownership of the all the content within the report.

This admission from the Trustees should be a wake-up call to Congress. MACRA isn’t working like it was supposed to, and it will eventually lead to even a bigger mess than the SGR created.

Unfortunately, because of sequestration and the “budget neutrality” requirement under the physician fee schedule (PFS), we again have a mini “SGR” on our hands. To take a trip down memory lane, the SGR formula triggered huge automatic cuts to physician payments, which Congress averted each year from 2003 up until the passage of MACRA in 2015. The annual song and dance Congress underwent to enact the SGR fix was not easy by any means, and in many years, it was extremely frantic and came down to the wire. While the passage of MACRA created a short reprieve from this annual ritual, Congress has been back at since the end of 2020, when CMS finalized a 10 percent cut to the 2021 PFS conversion factor and Congress stepped in to block the majority of the reduction from taking effect.

The Medicare Trustees are clearly saying that from here on out, things will only get worse, not better. Although the PFS budget neutrality requirement and sequestration have been the factors that have forced Congress to spring into action the last couple of years, the PFS updates set by MACRA will lead to even bigger issues. The main flaw of MACRA from its inception was that it included extremely small payment updates—updates that don’t even come close to accounting for inflation. And what’s worse, these small updates are set to continue forever—with no end date set by the legislation. Therefore, the gap between actual physician payments set by MACRA and appropriate physician payments adjusted for inflation will continue to grow over time.

Since this gap is getting wider each year, the cost of enacting a permanent solution will also likely grow. Cost has been the biggest impediment that has prevented Congress from enacting legislation that would provide permanent inflationary updates to physician payments. Thus, as with the SGR, every time Congress enacts a temporary fix and kicks the can down the road, they are just making the problem worse in the long term.

I don’t want to seem all doomy and gloomy here, but I do want to emphasize the urgency of this issue. ACEP and other medical societies have repeatedly pushed Congress to enact permanent reform, and the HHS Secretary, Xavier Becerra, has even expressed interest in working with Congress on a long-term solution. And now you know that the Medicare Trustees have been warning us for the last few years that things are going to get really bad if Congress doesn’t act.

So, will Congress listen to any of these voices? That remains to be seen—but what is clear that if it doesn’t, the mini SGR that we are now experiencing will officially become SGR 2.0— which will be worse than the original SGR. Avoiding that from happening should be one of Congress’ top Medicare-related priorities, right up there with ensuring that the HI Trust Fund doesn’t go bankrupt. And that, my friends, is my biggest takeaway from the Medicare Trustees Report!

Until next week, this is Jeffrey saying, enjoy reading regs with your eggs.