The Department of Health and Human Services (HHS) has announced how it plans to allocate more of the $100 billion provider relief funding that was included in the CARES Act. These allocations are in addition to the $30 billion that was already distributed. Below is a brief overview of the announcement.

$20 billion General Allocation: HHS is allocating another $20 billion to all health care providers. The total you or your group receives—both from the initial $30 billion and the new $20 billion—will be based on your 2018 total net revenue. To estimate how much a provider will receive in total from both the initial $30 billion and additional $20 billion general allocation, HHS provides this formula:

(Individual Provider 2018 Revenue/$2.5 Trillion) X $50 Billion = Expected General Distribution

Note: Total revenues of Medicare facilities and providers in 2018 is estimated to be $2.5 trillion.

There are numerous steps you will need to take to receive a portion of this additional $20 billion (NOTE: This information is up-to-date as of April 27, 2020, and is subject to change).

If you received funding from the first $30 billion, you are required to attest to the required terms and conditions. You must attest to the terms and conditions associated with the first $30 billion in order to receive funding from this second $20 billion tranche. Per the American Medical Association (AMA), there is conflicting information about whether a provider who hasn’t previously received money from the first round of funding can apply for this round.

You must log into the General Distribution Portal to provide revenue information. Detailed instructions on what information you need to provide are included in a frequently asked questions (FAQ) document HHS has produced, but overall include:

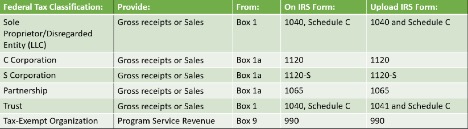

- A provider’s “Gross Receipts or Sales” or “Program Service Revenue” as submitted on its federal income tax return

- The provider’s estimated revenue losses in March 2020 and April 2020 due to COVID-19;

- A copy of the provider’s most recently filed federal income tax return; and

- A listing of the TINs any of the provider’s subsidiary organizations that have received relief funds but that DO NOT file separate tax returns.

HHS provides the following table highlighting exactly what revenue to report from your tax returns based on what type of group/organization you are:

You will also need your W-9 and Medicare or Medicaid ID number.

HHS will use this information to calculate your payment, which as stated above, is based on 2018 net revenue. Like your first payment, HHS will deposit the money electronically into the account that you have on file with Medicare. The goal is to deposit the funds within 10 days of submitting the required information. Although the fund is limited to $20 billion (and, as of April 24, HHS has stated that $10 billion has already been distributed), HHS claims that the remainder will not be distributed on a first come first served basis. HHS will be processing applications in batches every Wednesday at 12:00 noon EST. Thus, if you don’t submit the required information in by Wednesday, you have until the following Wednesday to complete the application—and so on.

After you receive the funds, you must log back into the CARES Act Provider Relief Fund attestation portal to confirm receipt and agree to ANOTHER set of terms and conditions. This second set of terms and conditions is similar to the first, but not identical. Both sets of terms and conditions (both for the initial $30 billion and the subsequent $20 billion) can be found here.

IMPORTANT NOTE: ACEP strongly recommends that a financial expert in your group and/or your accountant review all the instructions extremely carefully, enter the information into the portal, and review and attest to both sets of terms and conditions.

Here are some useful sources of information to review:

- The HHS Provider Relief Home Page

- HHS Detailed FAQs, which go into detail about the financial information you need to submit.

If you have questions, please reach out to the provider relief hotline at (866) 569-3522.

$10 billion for Providers in Hot Spots: $10 billion of the funding will be allocated for a targeted distribution to hospitals in areas that have been particularly impacted by the COVID-19.

$10 billion for Rural Health Providers: $10 billion will be allocated for rural health clinics and hospitals.

$400 million for Indian Health Service (IHS) Facilities: $400 million will be allocated for IHS facilities, distributed on the basis of operating expenses.

Reimbursement for Providers Treating Uninsured COVID-19 Patients: Every health care provider who has provided treatment for uninsured suspected or confirmed COVID-19 patients on or after February 4, 2020 can request claims reimbursement at Medicare rates, subject to available funding.

Providers can register NOW for the program here and begin submitting claims in early May. ACEP encourages you to review the information in this registration portal. It appears that emergency department visits that lead to an order of or administration of a test (i.e. testing related services) are covered under this program. However, for any treatment of COVID-19 positive patients, you will only receive reimbursement if the primary diagnosis on the claim is COVID-19. The billing codes are found here.

The program’s website can be found here, and some frequently asked questions can be found here.

Finally, it is important to note that there are two sets of terms and conditions associated with this program:

- Terms and Conditions Associated with Treatment Services

- Terms and Conditions Associated with Testing Services

On April 30, the Health Resources & Services Administration (HRSA) held a webinar to discuss the program. A summary of the webinar can be found here.

HHS also announced that some providers will receive further, separate funding, including skilled nursing facilities, dentists, and providers that solely take Medicaid.

Finally, it is important to note that the Paycheck Protection Program and Health Care Enhancement Act (the COVID 3.5 package), which was signed into law on April 24, added $75 billion to the fund on top of the initial $100 billion.

Related: You received financial relief. Should you keep it?