ACEP ID:

- My Account

- My CME

- Sign Out

ACEP ID:

By Richard A. Schmitt, MD, FACEP

2005 State Legislative/Regulatory Committee

In 2002, the ACEP State Legislative/Regulatory Committee was tasked with producing an information paper that provided an overview of ideal elements of tort reform, which was intended to assist ACEP chapters in the pursuit of meaningful reforms in their states. This objective was achieved with the development and subsequent online publication of "Communities in Crisis: Achieving Professional Liability Reform, State by State," an informational document with an extensive bibliography.

While attempts at federal tort reform during the subsequent two years remained unsuccessful, many states have become actively involved in the legislative battle for professional liability reform. Several states have passed medical liability reform bills with varying degrees of success in incorporating all elements of ideal tort reform, as listed in the informational paper noted above.

In a continuing effort to be responsive and supportive to the individual chapters, the ACEP State Legislative/Regulatory Committee was tasked with evaluating the effectiveness of liability reform measures that subsequently passed in various states.

The committee sought to identify and review successful chapter legislative efforts that could serve as models for other chapters, as well as identify the impact reforms are having and which incremental reform elements might be particularly successful in achieving the goals of decreasing insurance rates, increasing availability, or decreasing the frequency of medical malpractice lawsuits.

Research of public data was undertaken including a review of available state legislative, judicial, and liability carrier information. State chapters were also provided with a draft of this report and asked to provide any additional pertinent data from their states.

As noted in the U.S. Department of Health and Human Services report, "Confronting the New Health Care Crisis: Improving Health Care Quality and Lowering Costs By Fixing Our Medical Liability System," the insurance crisis is less acute in states that have reformed their litigation systems. States with limits of $250,000 or $350,000 on non-economic damages report average combined highest premium increases of 12 – 15%, compared to 44% in states without caps on non-economic damages, as shown in the following table, which compares premium increases in selected states with a $250,000 cap on non-economic damages to states without such a cap in 2001:

| TABLE 5. Comparison of States with Caps to States without Meaningful Non-Economic Caps (Average Premium Increase) | |||

| States with Caps < $250,000 | States without Caps | ||

| California | 20% | Arkansas | 18% |

| Indiana | 15% | Connecticut | 50% |

| Montana | 21% | Georgia | 32% |

| Utah | 5% | Nevada | 35% |

| New Jersey | 24% | ||

| Oregon | 56% | ||

| Pennsylvania | 77% | ||

| Washington | 55% | ||

| Ohio | 60% | ||

| West Virginia | 30% | ||

| Average | 15% | Average | 44% |

| States with Caps < $350,000 | States without Caps | ||

| California | 20% | Arkansas | 18% |

| Hawaii | 0% | Connecticut | 50% |

| Indiana | 15% | *Georgia | 32% |

| Michigan | 39% | *Nevada | 35% |

| Montana | 21% | New Jersey | 24% |

| New Mexico | 13% | Oregon | 56% |

| North Dakota | 0% | Pennsylvania | 77% |

| South Dakota | 0% | Washington | 55% |

| Utah | 5% | *Ohio | 60% |

| Wisconsin | 5% | *West Virginia | 30% |

| Average | 12% | Average | 44% |

| SOURCE: Medical Liability Monitor, 2001. Percentages represent the combined average of the highest premium increases for OB/GYNs, Internists, and General Surgeons among select states, 2000-2001. Average highest premium increase is derived from the highest potential premium increase among internal medicine, general surgery or obstetrics/gynecology specialists in that state during 2001. These combined averages are not weighted. *West Virginia had a $1,000,000 cap. Georgia, Nevada, Ohio and West Virginia have subsequently implemented lower damage caps. | |||

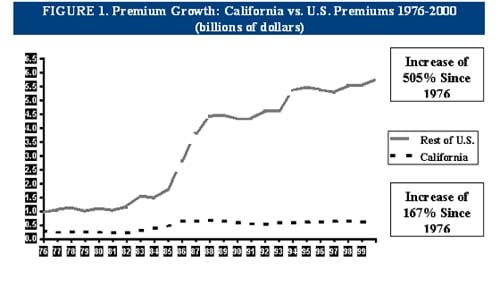

The Medical Injury Compensation Reform Act of 1975 (MICRA) was passed in California, and has been used as a model for many other states. Among the number of reforms contained in MICRA, a $250,000 limit on non-economic damages, a provision for periodic payment of damages, and shortening the time that a lawsuit could be filed were a few of the ideal elements of this model reform effort. California has more than 25 years of experience with this reform in place. It has been a success. Doctors are not leaving California. Insurance premiums have risen much more slowly than in the rest of the country without any effect on the quality of care received by residents of California. Insurance premiums in California have risen by 167% over this period while those in the rest of the country have increased 505%. This has saved California residents billions of dollars in health care costs and saved federal taxpayers billions of dollars in the Medicare and Medicaid programs.

Two more recent state tort reform initiatives that were successful occurred in Texas and Florida. As the enclosed 50-state chart indicates, data from Texas would anecdotally suggest that successful medical liability reform does have a positive effect on the number of claims filed (down approximately 80 percent), premium rates (declined 8 – 18%), and improved access to healthcare (increases in the numbers of physicians in higher risk specialties). Of course, the Texas ACEP chapter was successful in leading a coalition to pass a constitutional amendment allowing the legislature to set caps on damages. Thus the current constitutional challenges to Florida’s tort reform efforts have not occurred in Texas.

There are numerous challenges in accessing important information needed to identify the impact of recent reforms. The most obvious is that there has been inadequate time elapsed since reforms were passed in most states to obtain accurate financial data from liability insurance carriers. The liability carriers have also been reluctant to share data. The legislative reforms in each state are unique, and therefore it may be difficult to generalize the effect of incremental reforms. Any constitutional challenges, as seen in Florida, will delay the full impact of reforms; therefore delaying any effect on rates. Also, a flurry of lawsuits filed just prior to the implementation of legislation reform, as was noted in Texas, would have a delaying effect on premiums or accessibility of liability coverage. And a recent study by law professors at several schools minimizing the impact of a 135 percent increase in Texas liability premiums raised the concern about the introduction of bias into any data in order to affect a particular political agenda. These are just a few of the challenges the committee noted while attempting to gather the requested information.

Some of the following information is therefore necessarily incomplete and anecdotal. Studies have shown that a three to five-year time frame after legislative reform is necessary to assess the subsequent impact on the particular parameters studied. These parameters include the following:

Recent state liability reforms enacted from 2003 to 2005 are listed. That information is accompanied by any identified changes in the studied parameters in each of the states. This spreadsheet is meant to be a work in progress, and can be updated as individual states pursue additional reform efforts and more information on the liability environment becomes available. It is hoped that with time, more objective data can be obtained and utilized to better guide tort reform efforts by individual state ACEP chapters.