Last week, ACEP and the Emergency Department Practice Management Association (EDPMA) submitted a letter to the U.S. Departments of Health and Human Services (HHS), Labor, and Treasury (the Departments) in direct response to a meeting we participated in on January 5, 2023, where we discussed issues related to the federal dispute resolution process under the No Surprises Act. ACEP also released a press release highlighting our letter.

The January 5 meeting was productive and included stakeholders from the across the physician, hospital, health insurer, and employer communities. In response to the meeting, we were asked to provide the Departments with an overview of the unique facets of emergency care and billing and how that influences the type of information that emergency medicine practices receive after an emergency department visit.

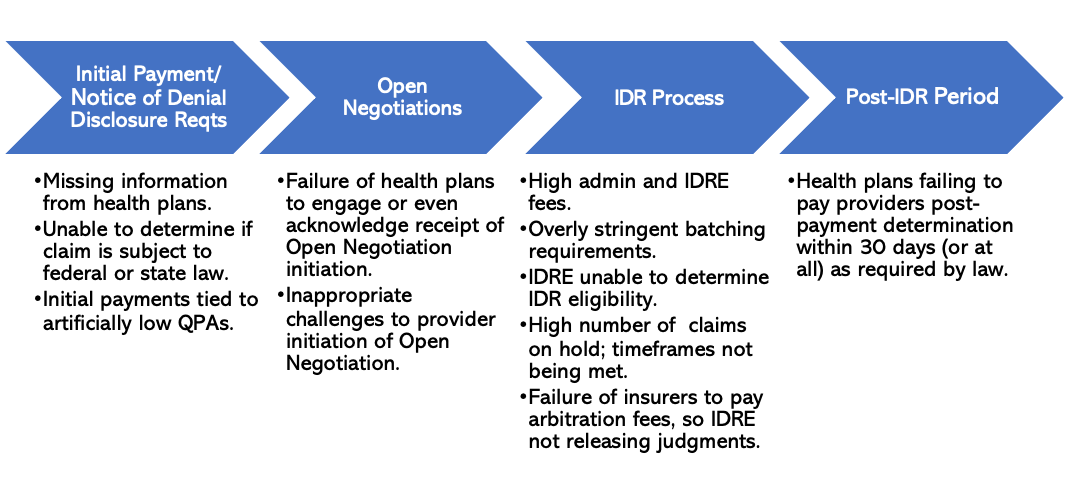

Further, we wanted to provide additional, specific recommendations on how each phase of the dispute resolution process can be improved. Unfortunately, as reflected in the table below, there are issues at every step along the way, from the time physicians receive the initial payment or notice of denial for an out-of-network service, to the Open Negotiations and independent dispute resolution (IDR) processes, and ultimately to the post-IDR period. Throughout each step of the process, there is a perceived lack of enforcement of all the statutory or regulatory requirements, thereby allowing these issues to remain ongoing and unchecked, with little recourse to the party that is not complying with the requirements.

In the letter to the Departments, ACEP and EDPMA lay out targeted recommendations to address each of these specific issues.

So, let’s dive in!

Initial Payment Phase

Starting with the first phase, in many cases, the physician group does not receive all the information required to be disclosed by health insurers at the time of the initial payment or notice of denial. In some cases, the qualifying payment amount (QPA) for the item or service billed is not being clearly identified, and a certifying statement that affirms that the QPA was calculated properly and that it serves as the recognized amount for the purposes of calculating patient cost-sharing is missing. This lack of information makes it difficult for physician groups and eventually for certified IDR entities to determine whether a claim is eligible for the federal IDR process.

Our recommendations to address these issues (many of which we have made previously) about how to address the lack of information that physician groups are receiving from health insurers both during the initial payment and notice denial phase are:

- Mandate Plan Type Disclosure: The Departments should require that the plan type be disclosed at the time of the initial payment or notice of denial, as this information is not available on a patient’s insurance ID card (if that is even obtainable). Without having the plan type, physician groups would not know whether the plan is a fully insured or self-insured plan, and whether it is therefore subject to the federal or state dispute resolution process.

- Mandate Use of RARCs: The Departments should require that health insurers use specific No Surprises Act Remittance Advice Remark Codes (RARCs) that lay out much of the information physician groups need to know to go through the dispute resolution process. These codes should be provided at the time of the initial payment or notice of denial along with the other pieces of information highlighted above. The RARCs will also provide certified IDR entities with dispositive information about whether a particular claim is eligible for the federal IDR process.

Moving on, I have often also highlighted a number of flaws with the qualifying payment amount (QPA)—which is the median in-network rate for the same services provided by the same health plan in a specific geographic region. This amount not only helps inform patient cost sharing and is a factor in the IDR process, but often is (although not required) used as a basis for the initial payment for a service.

Two main issues with the QPA that we’ve repeatedly talked about are:

- The QPA methodology finalized by the Departments is leading to artificially low QPAs that do not reflect market-rates. It was designed to limit cost-sharing liabilities and is not a market-based indicator of appropriate payment for an item or service.

- We are also hearing complaints that health insurers are miscalculating the QPA, leading to QPAs even lower than what proper adherence to the methodology would dictate. This combination of the QPA methodology and the miscalculations has led to QPAs that “don’t even pass the laugh test”—those that are so low that they are even significantly below Medicare and Medicaid payment rates.

To address these issues, ACEP and EDPMA recommend that the Departments:

- Increase Transparency Around Calculation of the QPA: It is essential that the Departments require health insurers to disclose the methodology used to calculate the QPA for an out-of-network claim so that physician groups are ensured it is calculated correctly and in line with the regulatory requirements. Currently, there is little to no recourse for physician groups who believe that the QPA is miscalculated. While they can submit a complaint, the initial payment they receive for that service is still, in most cases, based on an incorrectly calculated QPA. Currently, physician groups are restricted from requesting from health insurers specific information on how the QPA was calculated (i.e., to “check their math”), so requiring more transparency is the ONLY way to ensure that health insurers actually adhere to the methodology.

- Scale up and Publicize Auditing of the QPA: ACEP and EDPMA understand that the Departments have begun with their statutorily required audits of the QPA calculations. However, to enhance transparency, the Departments should scale up and publicly report on the results of these audits.

- Modify the QPA Methodology to Ensure that the QPA Reflects Market Rates: ACEP and EDPMA have requested numerous modifications to the QPA methodology in previous comments. We continue to be especially concerned about the decision to use each contracted rate as a single data point when calculating a median contracted rate. The rate negotiated under a contract constitutes a single contracted rate regardless of the number of claims paid at that contracted rate. We request that the Departments base the rate on the total number of actual payments issued to individually contracted physicians. By basing the contract on claims rather than contracts, the QPA would more accurately reflect the actual negotiated rates between payors and physician groups. Health insurers should also be reminded that they are not required to tie the initial payment to the artificially low and potentially miscalculated QPA. The initial payment is supposed to represent a reasonable payment in full for the service that was delivered—and in many cases, the QPA, which was designed to keep patient cost-sharing low, does not reflect a reasonable payment.

Open Negotiations Phase

We have heard from many of you that health insurers are simply not engaging at all in this part of the process—which is supposed to be an effort by physician groups and health insurers to negotiate in good faith and try to come to a solution before the IDR process. The lack of engagement by health insurers is counter to the overall intent of the No Surprises Act to use the IDR process as a last resort-- and is a significant contributing factor toward the high number of disputes that advance to the IDR.

Some stakeholders during our January 5 meeting did note that part of the reason why there may not be much engagement during this part of the dispute resolution process is the fact that both the statute and the regulations do not lay out a particular structure to Open Negotiations nor do they articulate any goals or parameters of the negotiations. Health insurers also reported that the notice of Open Negotiations was frequently going to the wrong contact person, so they had no way of tracking which claims had entered into the Open Negotiations Process.

Thus, ACEP and EDPMA’s overall recommendation to address this lack of engagement in the Open Negotiations process is to:

- Include the Open Negotiations Process in the IDR Portal: The Departments should consider incorporating the Open Negotiations Process into the IDR portal. Doing so could help both health insurers and physician groups better track what claims are entering the dispute resolution process and when the 30-day Open Negotiations Process begins. There could also be a way to assign an identification number to specific items or services under dispute to better track them through the process. The updated portal could also clearly include the contact information, including the email addresses, for all the key contacts involved in the dispute. Finally, it would formalize the Open Negotiations Process and provide a more structured way for health insurers and physician groups to share information and try to resolve disputes before the IDR process.

IDR Process and Beyond

Now to the last step of the process. And here is where we get to the most issues! First, the high cost of the process and the fact that many IDR claims are currently on hold are causing smaller groups to be shut out of the process altogether. Only larger groups can afford it! In fact, some billing companies are instructing smaller groups not to use the process at all.

Further, some physician groups in the January 5 meeting noted the extremely concerning trend related to health insurers’ failure to pay what they owe to the physician group if a certified IDR entity finds in favor of the physician group. Many health insurers are simply not paying the amount owed within the required 30-day period, if at all, despite numerous attempts by physician groups to collect the payment they are entitled to under the terms of the arbitration. One group noted during the meeting that it has not received the amount owed to it in over 90 percent of the cases in which the certified IDR entity ruled in its favor (the eligibility rate and win rate was also over 90 percent, demonstrating a high level of reasonableness and good faith in utilizing the IDR process).

Our recommendations to improve the accessibility, transparency, and enforcement of the IDR process are as follows:

- Reduce the IDR Fees in 2023: The Departments should immediately rescind the significant increases in both the administrative fee and the fees that certified IDR entities can charge. These fees already create a financial barrier that prevents physician practices from participating, especially smaller and rural practices. These increases will further limit what types of claims go through the IDR process.

- Make Enforcement and Auditing More Transparent: The primary mechanism for addressing non-compliance with the No Surprises Act is on a case-by-case basis through the submission and resolution of individual complaints.

We therefore recommend that the Departments release aggregated information about these cases. This information should also be broken out by state to help provide more granular data and potentially answer some of the questions posed during the meeting about the possible reasons for geographic variation among IDR cases.

Releasing all of this information will reduce the overall number of complaints and increase compliance of all No Surprises Act requirements. Further, analysis of these complaints could help determine which health insurers need to be audited. Auditing is critical to ensuring that health insurers have an incentive to comply with the statutory and regulatory requirements. The Departments should therefore publicly report auditing results, as well as best practices.

- Enforce Required Payments: Health insurers who are not paying what they owe to a physician group after the IDR process is completed must be penalized and forced to compensate the physician group the total amount owed plus interest.

During the meeting, multiple participants also stated that the rules and requirements around batching multiple claims through the IDR process at once are leading to significant confusion as well as an increase in the number of claims going through the IDR process, contradicting the intention of batching to decrease the volume of claims. Having to put small batches through the IDR process has become even more concerning given the significant increase in IDR fees in 2023. Not only did the Departments announce a 40 percent increase to the maximum amounts that certified IDR entity fees could charge in 2023, but the Departments also just recently announced a 600 percent increase in the administrative (non-refundable) IDR fee that the Departments charge—from $50 to $350. With these increases, the financial burden of entering the IDR process will become even more cost-prohibitive for many physician groups who have limited infrastructure or resources. The high administrative fee of $350 specifically creates an artificial threshold for the IDR process—a barrier that Congress explicitly omitted from the statute despite several proposals for thresholds offered along the way. If claims are less than $350 and cannot be batched together to exceed this threshold, it is actually more expensive to enter the IDR process than to adjudicate a low payment to a claim, thereby limiting what types of claims can go through the IDR process, and unfairly providing insurers with further advantages in the process.

Here is our major recommendation to improve batching:

- Modify Batching Rules to Have Fewer, Larger Batches Rather than More, Smaller Batches or Individual Disputes: The Departments should take a careful look at all their batching requirements and ensure that they are 1) simple and easy to understand; and 2) do not require physician groups to have access to information that they do not have. This should at least include a modification to how batching is conducted for self-insured claims. In the alternative, the Departments must require that health insurers provide all information necessary to correctly batch claims in tandem with delivery of the initial payment.

Finally, some stakeholders during the January 5 meeting raised the issue that it was difficult to transfer both the IDR administrative fee and the certified IDR entity fee to the certified IDR entity, as required. If the certified IDR entity does not receive the fees for both parties, the entity cannot render a decision—and this has contributed to some delays in the IDR process. One physician group said that certified IDR entities have different systems in place to electronically collect the fees (and noted that at the be process, one entity actually at one point had even required the use of PayPal to receive the fees)!

Here is our recommendation to address this issue:

- Require Electronic Payment Uniformity Among Certified IDR Entities: Certified IDR entities should have a uniform process in place to electronically collect all the IDR fees and refund the winning party the certified IDR entity fee. By creating a streamlined process of exchanging fees associated with the IDR process, there would be less interruptions to process and more adherence to the statutorily required timeframes.

I know that’s a lot and our letter is pretty comprehensive, but there is a plethora of issues with the process! We hope that the Departments will listen to our specific recommendations, and we also will continue working closely with the federal government and you all to make this process tenable. If it continues to go down this road (i.e., broken!), there will be disastrous impacts on both in-network and out-of-network rates—causing major patient access to issues and leading to more provider consolidation (as some smaller groups will unfortunately no longer be financially viable). Our goal is that we never get to that point!

Until next week, this is Jeffrey saying, enjoy reading regs with your eggs!